Cosmetics Inspiration & Creation presents 5 key predictions that will shape the Beauty industry in 2023 and beyond, as we look ahead with optimism, creativity and conviction.

Through a period of polycrisis, consumers are discovering strengths that they never knew they had. They are more resilient, more adaptable and more connected than they ever realised. And if recent global events have proven anything, it is that health, freedom, and the future of the planet are all deeply interwoven. The success of one relies on the success of another.

“Our future is symbiotic. And yet, the desire for individual recognition and expression remains a prescient driver. As we move forward, consumers will continue to explore the special tension that exists between collective responsibility and personal growth, and between the quest for the optimised self and for globalised empathy,” explains Leila Rochet, Chief Innovation Officer, Cosmetics Inspiration & Creation.

For a deep dive into 4 of these key trends, we hope you can join us at the next edition of MakeUp in Los Angeles, on February 16 & 17 2023. Leila Rochet will be hosting a series of Beauty Talks where she will be joined by industry insiders to explore many of the themes outlined below. See the trends illustrated through the latest products sourced from all over the globe at our Inspiration Bar.

Book your place here!

The predictions:

1. Eco-Collectivism: From Sustainability to Augmented Empathy

Armed with increased knowledge, consumers will drive brands even harder to alter their behaviours in order to recenter humanity, source with respect, honour community and support rigorous ethical practices. In 2023 brands must become empathetic ambassadors, and respond to a new generation of eco-socio intellectuals.

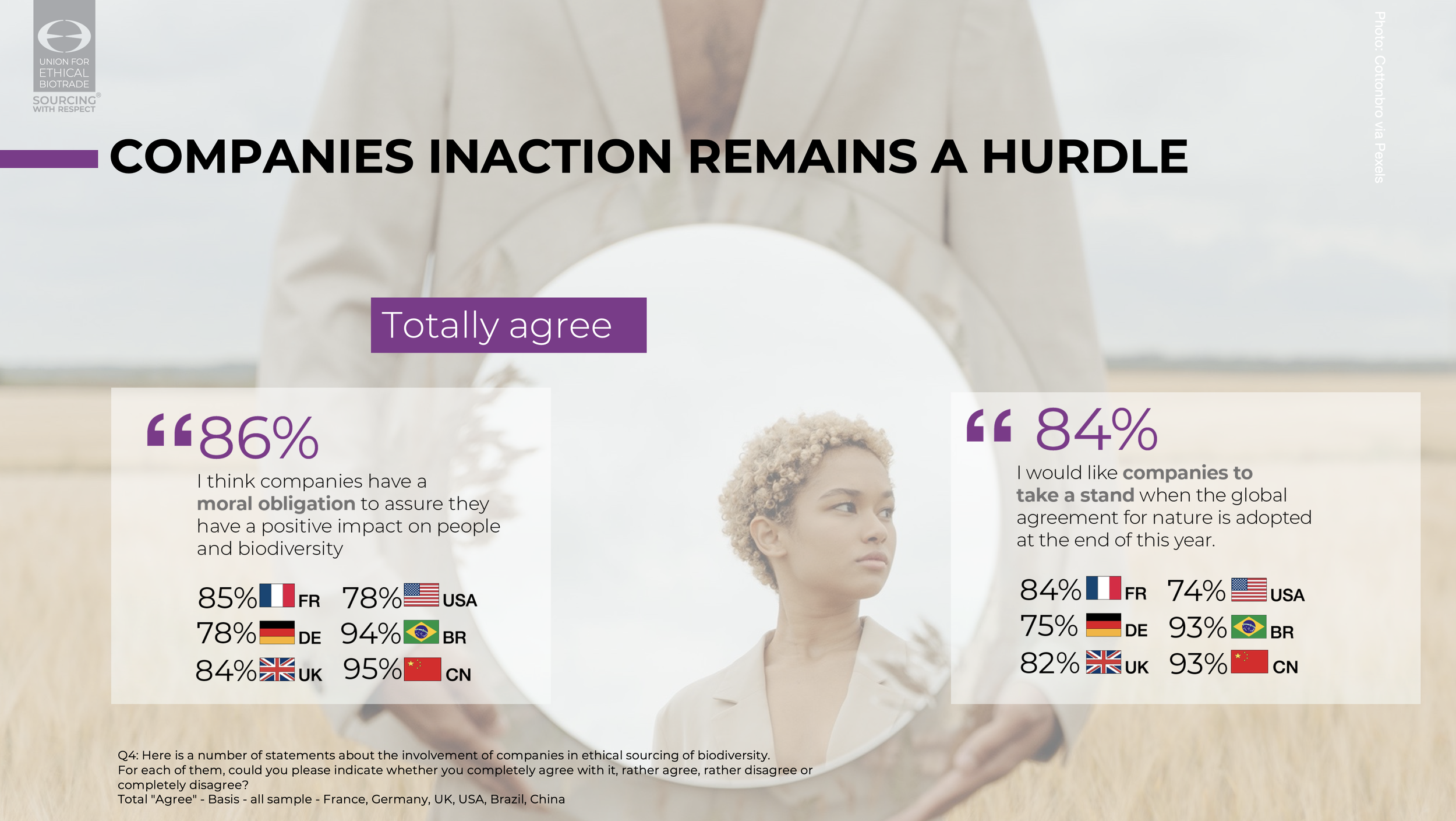

Results from the 2022 UEBT Biodiversity Barometer demonstrate there is now a global consensus that while planetary health is a clear priority in the minds of consumers, so are issues surrounding workers' rights and equality. Sustainability issues are now rightly being understood in the context of wider geo-political events. Taking a strong stand on bio-diversity, French brand Eclo is a clean eco-native that only works with ingredients that are local to its Brittany HQ and which also help regenerate the soil and the seabed.

Taking a collective responsibility approach, Indigenous-owned brands often balance respect for nature with individual growth. Operating within this type of intrinsically holistic value system The Yukon Soaps Company uses native, wild botanicals hand-picked by elders and local young people. The brand teaches harvesting practices that foster an emotional connection to the land. Through these shared experiences, the company triggers acts of healing within the Yukon community.

2. Artphoria: From Colour-Dosing to Creative-Finessing

Gen Z’s takeover of social media has created a space where niche is the norm, and micro-expressions are the new mainstream. This mindset shapes a new generation of beauty connoisseurs, who bring a fine art approach and an exacting attitude to the beauty sphere. As consumer confidence grows and their skills continue to develop thanks to the TikTok explosion, we see a growing desire to express individuality through exquisite artistry.

Daring to be rare is something to be encouraged by brands, and those that speak to individuality and trigger creativity through wild innovation will gain traction. Pleasing is a brand that inspires consumers to master micro-artistry, coupled with an approach that is embracive of every identity. Its ultra-inclusive storytelling paves the way for a “Flat Age Society” where traditional age segmentation has diminishing influence. Pleasing also encapsulates another key element - escapism.

3. Future ArchiTech: From Innovation Hunters to Progress Pioneers

The answer to tomorrow's challenges lies in adopting a science-first and solution-focused approach. This mindset is permeating the beauty sector, where radical innovation is welcomed by today’s logical and results-driven consumers. Younger generations are facing global challenges with a practical mindset, leaning into science and technology to forge world-changing solutions. STEM careers (science, technology, engineering and maths) are now the #1 attraction for Gen Z, according to a recent study, with particular popularity among females and people of colour.

Brands must embrace this appetite for innovation, leaning into other categories for inspiration to deliver game-changing solutions. Aeir is one such beauty brand that is using the latest technology to develop future-facing products. Combining their experiences at Tesla and the École Cantonale d’Art de Lausanne (ECAL), the brand founders have created a next-gen wellness fragrance that utilises NASA technology, zero extraction, bioengineering and generations-old craftsmanship.

Engineered nature will also propel the sustainability narrative in 2023, as more brands invest in bio-science innovation to deliver smart, and green, solutions. In 2022 we saw Ulé (France) and Monday Musem (South Korea) lead the way with the adoption of vertical farming techniques. At Ulé, experts create plant extracts cultivated in a vertical farm in the center of Paris, which allows the brand to harvest plants at their maximum potency, using the whole plant in the process. Monday Museum’s Pink Inspiration Cream Drop uses red clovers cultivated using smart farm technology that is said to save up to 70% energy.

4. The Optimised Self: Exploring the Personal Ecosystem

We are entering an era of intimately adaptive beauty that responds to the individual or is tailored specifically for individual needs. Deep care is delivered on both an emotional and physical level as personal healing becomes a priority. Science and technology are leveraged to understand and accentuate your individuality, with an emphasis on inner beauty rather than aesthetic transformations.

The continued fetishization of health and immunity will drive the creation of unexpected territories, ushering in new opportunities for beauty supplements, skin-optimising trackers, AI-aided personalization, and at-home beauty devices that deliver ultra-bespoke and professional results. In fact, consumer interest in beauty tech is set to continue to increase continuously over the next five years, reaching $8.93 billion by 2026.

With personal growth and self-improvement becoming central drivers, brands are expanding the opportunities for health and well-being optimization. Homecare brand byMATTER has added a bio-active bedding collection to its range of cleaning products, which is designed to optimise skin health. Pillowcases made from Seawell, an innovative material formulated with seaweed and enriched with collagen, facilitate an exchange of amino acids, vitamins, minerals and antioxidants between fabric and skin while users are asleep.

Providing a wellness wearable that restores inner balance, Lokai is a holistic bracelet infused with white beads that contain Himalayan water (a ‘high’ ingredient) and black beads containing clay sourced from the Dead Sea (a ‘low’ ingredient). The idea is that the secret ingredients will keep wearers hopeful and humble, accordingly.

5. The Emotional Biome: From Self-Care to Mind-Care

In a world that is perceived as super fragile, there is a heightened focus on mental wellness, brain care and psychological healing. Beauty that delivers emotional benefits on top of functional benefits will gain traction, as consumers look to balance feelings of vulnerability with products and experiences that simultaneously provide care and protection.

Consumers will also use beauty as a means of expressing their innermost feelings, as they re-focus on personal growth and inner tranquillity. The role of functional fragrances will become heightened, as consumers and brands explore the idea that perfume can deliver benefits that go way beyond scent. This is an idea explored by American light artist James Turrell who has developed a collection of crystal light panels and perfumes for Lalique, which play on the abstract concept of the light we see in our dreams. Turrell brings this ethereal quality to life in the form of tangible colour but also in the form of an abstract emotion, pushing “beyond what we think we know”.

Beauty imbued with cerebral and cognitive influence will play to the growing brain care category. Brain health supplements are forecast to grow at a CAGR of 8.3% from 2022 to 2030, as consumers explore new routes to optimise mind-care.

(Image: Anna Shvets via Pixels)